Returns

As of January 2026

|

Returns (a) |

Month |

Last 3 Months |

Year to Date |

Last 12 Months |

Last 3 Years (Annualized) |

Since Inception (Annualized) |

Start Date |

|---|---|---|---|---|---|---|---|

|

Money Market and Sovereign Bonds |

0,64% |

1,12% |

0,64% |

7,36% |

2,26% |

0,19% |

01-Aug-2013 |

|

Inflation-Linked Sovevereign Bonds |

0,61% |

0,73% |

0,61% |

6,75% |

4,67% |

1,79% |

05-Aug-2013 |

|

US Agency MBS |

0,47% |

1,30% |

0,47% |

8,58% |

- |

7,67% |

02-Nov-2023 |

|

Return in USD |

0,61% |

1,14% |

0,61% |

7,52% |

2,61% |

1,72% |

01-Apr-2007 |

|

Exchange Rate (CLP) |

-5,79% |

-8,73% |

-5,79% |

-13,12% |

1,94% |

2,50% |

01-Apr-2007 |

|

Return in CLP (b) |

-5,21% |

-7,69% |

-5,21% |

-6,58% |

4,60% |

4,26% |

01-Apr-2007 |

(a) Time Weighted Return (it is calculated as the growth rate of the funds that were invested through the period).

(b) Return in CLP corresponds to the sum of the percentage change of the exchange rate CLP/USD and the return in USD.

Returns for periods of more than one year are compound annualized rates while those for less than a year correspond to the change as seen in the stated period. With a view to meeting high standards of transparency and providing a better assessment of the gains or losses on investments, the Ministry of Finance discloses the fund's return in different time horizons and currencies. With respect to the horizon, it is important to note that, in keeping with the medium- and long-term investment policy, the return assessment should focus on that period, disregarding fluctuations that may occur monthly or quarterly. With regard to returns expressed in different currencies, the return in US dollars allows for an assessment that is more in line with the investment policy given that the fund's resources are wholly invested abroad and in foreign currency. The return in Chilean pesos is also disclosed. This return reflects changes in the peso-dollar exchange rate and, therefore, may experience greater fluctuations. Finally, as with any investment, past performance does not necessarily reflect future performance.

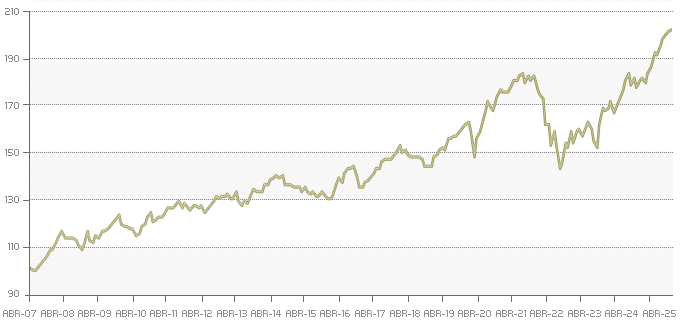

Fund performance is based on daily returns beginning at an initial value of 100.